Wednesday, December 8, 2010

Refinancing Retail Buildings & Net Lease Properties

New York, NY - We have data on refinancing retail condominiums, Apartment Buildings and Triple Net Lease Properties. Commercial Mortgage Lenders have capital prepared to fund commercial loans on these types of commercial property. Commercial Mortgage Lenders recently arranged capital to fund a $44 million commercial loan. This Commercial Loan was a refinancing for the retail condominium at 599 Broadway. This Investment Property is in Manhattan’s SoHo neighborhood.

This security for the commercial loan is situated at the intersection of Broadway and Houston Street in the Cast Iron Historic District. As we mentioned above for commercial loans, this retail property has excellent sources for funding. The Retail space includes the first three floors and lower level space of the 12-story building. This area is one of the better retail locations in SoHo. This obviously has the retail foot traffic that is needed to create income which shows triple net leased properties are deserving of commercial loans.

The borrower of this commercial loan was ABC Management Corp. This Commercial Mortgage was a 10-year, fixed-rate loan with Prima Capital Advisors. This transaction was helped along due to the skillful culmination of a long-term repositioning of 599 Broadway. They had a creative ownership structure utilizing a joint venture master lease. This creative leasing technique was led by the talented owners of this collateral. He helped to maximize the retail potential of this net lease investment.

American Eagle subleases the ground floor, second floor and lower level spaces through a 15-year lease. American Eagle is scheduled to open a flagship SoHo store in 2010. This American Eagle retail store is very welcomed in this area.

ABC Management Corp. was founded in 1977. ABC Management Corp is a commercial real estate investment and management company headquartered in New York. ABC Management Corp has an Investment Property Portfolio made up of various property. ABC Management Corp owns numerous commercial properties in the New York metropolitan area and nationally including residential apartment buildings, retail shopping centers, office buildings and warehouses.

If your Commercial Loan is coming due and will not be refinanced, these Commercial Mortgage Lenders will help you out. Also, Commercial Mortgage Lenders are able to help get your Commercial loan for a 1031 Exchange.

The main advantage of refinancing your commercial loan is that it provides a chance for you to receive the required capital in a short time with new lower interest rates. Regardless of whether you are looking for a commercial loan, CTL Financing, Mezzanine loan, or refinancing, Loanrise.com is dedicated to getting you the best rates. For all your commercial loan requirements, Contact loanrise.com and receive a free commercial loan quote.

Thursday, October 21, 2010

Buy Apartment Buildings or Refinance with Non-Recourse Loan

Santa Clarita, California – Information today for Commercial Loans is on refinancing Apartment Complexes. We have some unbelievable rates on Non-Recourse Loans for Apartment Buildings and Net Lease Properties. Commercial Mortgage Lenders have arranged capital to refinance a 752-unit apartment complex. The Commercial Loan on this Apartment Complex is a non-recourse loan and fully amortizing. This refinancing has commercial loan terms set at a 3.75% fixed interest rate. The Loan-to-value “LTV” was 82%. This commercial loan may be the largest financing yet in the HUD 223(f) program. This 223(f) program insures mortgage loans to facilitate the purchase or refinance of existing multifamily rental housing.

The Colony Townhomes has of two and three bedroom, two-story units. These Apartments contain granite counter tops, washer and dryers, fireplace, and two car direct-access garages, along with community amenities including five pools, a fitness center and five spas. These types of Apartment Buildings make fine collateral for the next Commercial Loan.

The Investment Property securing this commercial loan is the Colony Townhomes. The Colony Townhomes is located at 17621 Pauline Court in Santa Clarita. The Investment Property, Colony Townhomes provides residents with a charming yet intimate community. This Investment Property is situated in a cozy neighborhood that ensures the convenience of city life within a peaceful Canyon Country setting. These apartments are just minutes from great shopping and entertainment, as well as excellent upscale dining. Weekend getaways to Los Angeles and the beach. Net Lease Properties are an exceptional investment in the Los Angeles area. This scenario makes Santa Clarita an ideal, serene location just a short drive to the city and the San Fernando Valley.

A Non-Recourse Loan has many benefits. With a Non Recourse Loan, you are only responsible for the collateral associated with the Loan / Mortgage. If you default on the Loan, you lose only the Investment Property, the collateral. If the value of the asset dropped during the period of the Non-Recourse loan, the difference between the value and the loan does not have to be re-paid. In that case, the lender would be responsible for the debt.

Friday, October 8, 2010

Non-Recourse Loan on Arizona Mixed-Use Property

Scottsdale, Arizona - Commercial Loans reports today is coming from the beautiful city of Scottsdale. A commercial property, mixed-use project is getting a commercial loan for $70 million. This commercial loan is permanent financing used to help facilitate the acquisition of Scottsdale Quarter.

The Retail real estate investment trust, Glimcher Realty Trust, has cemented their ownership position of the Scottsdale Quarter, mixed-use project. This Commercial Real Estate used to secure the commercial loans is in north Scottsdale.

This Investment Property, Scottsdale Quarter is located east of Scottsdale Road across from Kierland Commons. The first phase opened in 2009 and includes Tenants such as H & M, Williams Sonoma Home, Apple, Oakville Grocery and Brio Tuscan Grill, as well as others. Phase 2 of this commercial real estate project is scheduled to open this fall. It will include a variety of boutique retail and restaurants, including Nike and True Food Kitchen. Currently undeveloped land, Phase 3 of commercial real estate project is yet to be determined.

The plan for Phase 3 has yet to be determined. It’s currently undeveloped land but could include office, hospitality, residential and retail.

This commercial loan helped Glimcher’s purchase of the land under Phases I and II of Scottsdale Quarter and allowed the REIT to consolidate the leasehold and fee positions. Reports have it that the "REIT" Real Estate Investment Trust purchased the fee simple interest to roughly 14.5 acres from Sucia Scottsdale LLC for $96 million.

Commercial Mortgage Lenders arranged this commercial loan with nice terms of five-years, and a non-recourse loan with a rate of 4.91% percent. The conduit loan is secured with collateral of the ground lease on the 600,000 square-foot Scottsdale Quarter.

A Non-Recourse Loan has many benefits. With a Non Recourse Loan, you are only responsible for the collateral associated with the Loan / Mortgage. If you default on the Loan, you lose only the Investment Property, the collateral. If the value of the asset dropped during the period of the Non-Recourse loan, the difference between the value and the loan does not have to be re-paid. In that case, the lender would be responsible for the debt.

The Retail real estate investment trust, Glimcher Realty Trust, has cemented their ownership position of the Scottsdale Quarter, mixed-use project. This Commercial Real Estate used to secure the commercial loans is in north Scottsdale.

This Investment Property, Scottsdale Quarter is located east of Scottsdale Road across from Kierland Commons. The first phase opened in 2009 and includes Tenants such as H & M, Williams Sonoma Home, Apple, Oakville Grocery and Brio Tuscan Grill, as well as others. Phase 2 of this commercial real estate project is scheduled to open this fall. It will include a variety of boutique retail and restaurants, including Nike and True Food Kitchen. Currently undeveloped land, Phase 3 of commercial real estate project is yet to be determined.

The plan for Phase 3 has yet to be determined. It’s currently undeveloped land but could include office, hospitality, residential and retail.

This commercial loan helped Glimcher’s purchase of the land under Phases I and II of Scottsdale Quarter and allowed the REIT to consolidate the leasehold and fee positions. Reports have it that the "REIT" Real Estate Investment Trust purchased the fee simple interest to roughly 14.5 acres from Sucia Scottsdale LLC for $96 million.

Commercial Mortgage Lenders arranged this commercial loan with nice terms of five-years, and a non-recourse loan with a rate of 4.91% percent. The conduit loan is secured with collateral of the ground lease on the 600,000 square-foot Scottsdale Quarter.

A Non-Recourse Loan has many benefits. With a Non Recourse Loan, you are only responsible for the collateral associated with the Loan / Mortgage. If you default on the Loan, you lose only the Investment Property, the collateral. If the value of the asset dropped during the period of the Non-Recourse loan, the difference between the value and the loan does not have to be re-paid. In that case, the lender would be responsible for the debt.

Sunday, October 3, 2010

Commercial Mortgage Lenders for Non-Recourse Loans

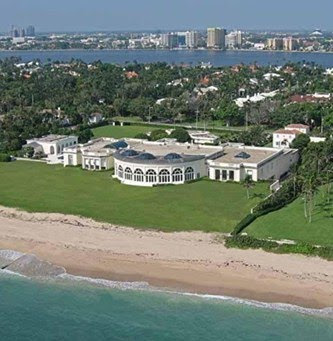

Palm Beach, Florida - We have the solution for Non Recourse Loans. Let our Commercial Mortgage Lenders assist you in finding a Non-Recourse Fixed Rate Retail Loan or Government Loan.

They will get you the best terms possible in today's marketplace!

Non Recourse Loans

Many NNN Properties -Triple Net are eligible for Non-Recourse Loans.

When buying Investment Property you can always try to get a Non Recourse Loan if available. The Non Recourse Loan is excellent when purchasing a Triple Net Lease Property.

We specialize in Commercial Loans from $500,000 to $25,000,000 +.

Contact us, HERE for a Loan Quote on a new Commercial Mortgage Loan or for commercial refinance rates.

We can assist with:

*CTL Financing (Credit Tenant Loans)

*Commercial Lending*FHA refinance

*Private money

*Interest only mortgages

*Construction loans

*Mezzanine Loans

They will get you the best terms possible in today's marketplace!

Non Recourse Loans

Many NNN Properties -Triple Net are eligible for Non-Recourse Loans.

When buying Investment Property you can always try to get a Non Recourse Loan if available. The Non Recourse Loan is excellent when purchasing a Triple Net Lease Property.

We specialize in Commercial Loans from $500,000 to $25,000,000 +.

Contact us, HERE for a Loan Quote on a new Commercial Mortgage Loan or for commercial refinance rates.

We can assist with:

*CTL Financing (Credit Tenant Loans)

*Commercial Lending*FHA refinance

*Private money

*Interest only mortgages

*Construction loans

*Mezzanine Loans

Thursday, August 19, 2010

Palm Beach Mortgage Available

Palm Beach, Florida - Some economists are mentioning we could be close to the bottom and they predict Real Estate should rise.

Some commodities have risen dramatically recently. It appears that the only asset class left in the cellar is real estate.

Some reasons to consider buying a Palm Beach County Home now are that sellers are desperate. Both home owners and lenders are eager to unload a flood of foreclosed and underwater properties. Buyers with the patience to push through these complex deals (many are REO or Short Sales) can save a bundle.

There is little competition right now as many people are sitting and waiting. Because most people don’t have what it takes to negotiate their way through short sales and REOs, patient investors are the winners. Palm Beach County has some real deals right now so consider getting a Palm Beach Mortgage soon.

We still have very low rates available for Palm Beach County home mortgages. If you believe inflation is inevitable, lock in your mortgage rate now.

Feel free to get the best mortgage quotes and mortgage advice by contacting us by EMAIL with no obligations.

Palm Beach Mortgage is ready to help you. We will help with a Jumbo Loan or Standard Mortgage.

We suggest Net Lease Properties for your Commercial Real Estate needs.

If you are need of a Commercial Loan check with Commercial Loans at Loanrise.

Some commodities have risen dramatically recently. It appears that the only asset class left in the cellar is real estate.

Some reasons to consider buying a Palm Beach County Home now are that sellers are desperate. Both home owners and lenders are eager to unload a flood of foreclosed and underwater properties. Buyers with the patience to push through these complex deals (many are REO or Short Sales) can save a bundle.

There is little competition right now as many people are sitting and waiting. Because most people don’t have what it takes to negotiate their way through short sales and REOs, patient investors are the winners. Palm Beach County has some real deals right now so consider getting a Palm Beach Mortgage soon.

We still have very low rates available for Palm Beach County home mortgages. If you believe inflation is inevitable, lock in your mortgage rate now.

Feel free to get the best mortgage quotes and mortgage advice by contacting us by EMAIL with no obligations.

Palm Beach Mortgage is ready to help you. We will help with a Jumbo Loan or Standard Mortgage.

We suggest Net Lease Properties for your Commercial Real Estate needs.

If you are need of a Commercial Loan check with Commercial Loans at Loanrise.

Tuesday, July 20, 2010

Palm Beach Mortgage Rates Hit Another Record Low

Palm Beach, Florida - Palm Beach Mortgage average interest on a 30-year fixed mortgage dipped to a new record low of 4.57 percent this week. That Mortgage rate is down from 4.58 percent a week ago, according to Freddie Mac, which began tracking rates in 1971.

Even with this news from Palm Beach Mortgage, the low rates may not provide much of a boost for the housing market. The problem appears to be that many people do not qualify for new mortgages or have already obtained loans at low rates this year.

Contact us for:

Feel free to get the best mortgage quotes and mortgage advice by contacting us by EMAIL with no obligations.

Palm Beach Mortgage is ready to help you. We will help with a Jumbo Loan or Standard Mortgage or Commercial Real Estate Mortgage.

Even with this news from Palm Beach Mortgage, the low rates may not provide much of a boost for the housing market. The problem appears to be that many people do not qualify for new mortgages or have already obtained loans at low rates this year.

Contact us for:

- Jumbo Mortgages

- Home Loans for Purchase of Real Estate

- Refinance of Real Estate Loans

Feel free to get the best mortgage quotes and mortgage advice by contacting us by EMAIL with no obligations.

Palm Beach Mortgage is ready to help you. We will help with a Jumbo Loan or Standard Mortgage or Commercial Real Estate Mortgage.

Tuesday, June 22, 2010

Palm Beach Mortgage Rates Are Down

Palm Beach Mortgage has news on the Mortgage market. Many Real Estate Investors have been waiting to see if mortgage rates would stay steady.

Home Mortgage Loan rates fell this week along with bond yields, according to Freddie Mac. The 30-year fixed-rate mortgage averaged 4.72 percent, down from 4.79 percent a week ago. Palm Beach Jumbo Mortgages are still available while rates on 15-year fixed-rate mortgages fell to another record low of 4.17 percent from 4.2 percent.

Also, the five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.92 percent, down from 3.94 percent last week. Finally, one-year Treasury-indexed ARMs (adjustable rate mortgages) fell to a new six-year-low of 3.91 percent, compared with 3.95 percent a week ago.

Palm Beach Mortgage also reports that Loanrise.com is coming for all of your Commercial Real Estate Mortgage needs.

Home Mortgage Loan rates fell this week along with bond yields, according to Freddie Mac. The 30-year fixed-rate mortgage averaged 4.72 percent, down from 4.79 percent a week ago. Palm Beach Jumbo Mortgages are still available while rates on 15-year fixed-rate mortgages fell to another record low of 4.17 percent from 4.2 percent.

Also, the five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.92 percent, down from 3.94 percent last week. Finally, one-year Treasury-indexed ARMs (adjustable rate mortgages) fell to a new six-year-low of 3.91 percent, compared with 3.95 percent a week ago.

Palm Beach Mortgage also reports that Loanrise.com is coming for all of your Commercial Real Estate Mortgage needs.

Friday, June 4, 2010

Palm Beach Mortgages & Home Loan Rates

The rates on this page are typically valid for credit scores of 700 and above. For scores from 680 to 699, borrowers would typically see increased fees up to 1% of the loan value, or an adjustment in the rate.

If you are seeking a Mortgage in excess of $417,000, recent legislation may enable lenders in certain locations to provide rates that are different from those shown in the table below. We recommend that you contact us by Email directly to determine what rates may be available to you.

Feel free to get the best mortgage quotes and mortgage advice by contacting us by EMAIL with no obligations.

Palm Beach Mortgage is ready to help you. We will help with a Jumbo Loan or Standard Mortgage.

We would like to make an announcement, coming soon for all your Mortgage and Non recourse loan needs is Loanrise.com.

If you are seeking a Mortgage in excess of $417,000, recent legislation may enable lenders in certain locations to provide rates that are different from those shown in the table below. We recommend that you contact us by Email directly to determine what rates may be available to you.

| National Average Mortgage Rates | |||

|---|---|---|---|

| Description | APR This Week | APR Last Week | |

| Home Equity Line of Credit | 4.901% | 4.898% | |

| 15 Year Fixed Conforming | 4.299% | 4.317% | |

| 15 Year Fixed Jumbo | 4.972% | 4.978% | |

| 30 Year Fixed Conforming | 4.877% | 4.893% | |

| 30 Year Fixed Jumbo | 5.556% | 5.577% | |

| 5/1 Year ARM Conforming | 3.878% | 3.905% | |

| 5/1 Year ARM Jumbo | 4.423% | 4.452% |

Feel free to get the best mortgage quotes and mortgage advice by contacting us by EMAIL with no obligations.

Palm Beach Mortgage is ready to help you. We will help with a Jumbo Loan or Standard Mortgage.

We would like to make an announcement, coming soon for all your Mortgage and Non recourse loan needs is Loanrise.com.

Friday, May 14, 2010

Mortgage Rates Fall To A Low For The Year

Palm Beach, Florida - Mortgage rates fell this week to the lowest level of the year, as rates on government securities declined. Fixed mortgage rates closely run on track with how interest rates are paid on long-term Treasury bonds.

The average rate on a 30-year fixed-rate mortgage fell to 4.93 percent, from 5 percent a week earlier. It was the lowest level since mid-December, when rates averaged 4.81 percent.

The drop came as many Investors shifted money from risky European debt to what they feel as safer, U.S. securities. Bond yields fell as a result, and that lowered mortgage rates, which helps Palm Beach Jumbo Mortgage rates.

The average fixed rate dropped to a record low of 4.71 percent last year. This week, the average on a 15-year fixed-rate mortgage was 4.3 percent, down from 4.36 percent. Rates on five-year, adjustable-rate mortgages averaged 3.95 percent, down from 3.97 percent

Feel free to get the best mortgage quotes and mortgage advice by contacting us by EMAIL with no obligations.

Palm Beach Mortgage is ready to help you. We will help with a Jumbo Loan or Standard Mortgage or Commercial Real Estate Mortgage.

The average rate on a 30-year fixed-rate mortgage fell to 4.93 percent, from 5 percent a week earlier. It was the lowest level since mid-December, when rates averaged 4.81 percent.

The drop came as many Investors shifted money from risky European debt to what they feel as safer, U.S. securities. Bond yields fell as a result, and that lowered mortgage rates, which helps Palm Beach Jumbo Mortgage rates.

The average fixed rate dropped to a record low of 4.71 percent last year. This week, the average on a 15-year fixed-rate mortgage was 4.3 percent, down from 4.36 percent. Rates on five-year, adjustable-rate mortgages averaged 3.95 percent, down from 3.97 percent

Feel free to get the best mortgage quotes and mortgage advice by contacting us by EMAIL with no obligations.

Palm Beach Mortgage is ready to help you. We will help with a Jumbo Loan or Standard Mortgage or Commercial Real Estate Mortgage.

Tuesday, April 27, 2010

Palm Beach Jumbo Mortgages & Home Loan Rates

The rates on this page are typically valid for credit scores of 700 and above. For scores from 680 to 699, borrowers would typically see increased fees up to 1% of the loan value, or an adjustment in the rate.

If you are seeking a Mortgage in excess of $417,000, recent legislation may enable lenders in certain locations to provide rates that are different from those shown in the table below. We recommend that you contact us by Email directly to determine what rates may be available to you.

| National Average Mortgage Rates | |||

|---|---|---|---|

| Description | APR This Week | APR Last Week | |

| Home Equity Line of Credit | 4.911% | 4.909% | |

| 15 Year Fixed Conforming | 4.449% | 4.422% | |

| 15 Year Fixed Jumbo | 5.181% | 5.149% | |

| 30 Year Fixed Conforming | 5.114% | 5.116% | |

| 30 Year Fixed Jumbo | 5.716% | 5.752% | |

| 5/1 Year ARM Conforming | 3.857% | 3.883% | |

| 5/1 Year ARM Jumbo | 4.534% | 4.536% |

Feel free to get the best mortgage quotes and mortgage advice by contacting us by EMAIL with no obligations.

Palm Beach Mortgage is ready to help you. We will help with a Jumbo Loan or Standard Mortgage.

Friday, April 16, 2010

Palm Beach Mortgage Rates & Jumbo Loans

The rates on this page are typically valid for credit scores of 700 and above. For scores from 680 to 699, borrowers would typically see increased fees up to 1% of the loan value, or an adjustment in the rate.

If you are seeking a mortgage in excess of $417,000, recent legislation may enable lenders in certain locations to provide rates that are different from those shown in the table below. We recommend that you contact us by Email directly to determine what rates may be available to you.

| National Average Mortgage Rates | |||

|---|---|---|---|

| Description | APR This Week | APR Last Week | |

| Home Equity Line of Credit | 4.911% | 4.909% | |

| 15 Year Fixed Conforming | 4.452% | 4.527% | |

| 15 Year Fixed Jumbo | 5.115% | 5.177% | |

| 30 Year Fixed Conforming | 5.123% | 5.195% | |

| 30 Year Fixed Jumbo | 5.693% | 5.760% | |

| 5/1 Year ARM Conforming | 3.973% | 4.002% | |

| 5/1 Year ARM Jumbo | 4.532% | 4.583% |

Feel free to get the best mortgage quotes and mortgage advice by contacting us by Email with no obligations.

Palm Beach Mortgage is ready to help you.

Labels:

Florida,

Home-Loan,

Jumbo,

Jumbo-Mortgage,

Lenders,

Loan,

Loans,

Mortgage,

Mortgages,

Palm-Beach-Mortgage

Tuesday, March 30, 2010

Palm Beach Mortgage Rates

The rates on this page are typically valid for credit scores of 700 and above. For scores from 680 to 699, borrowers would typically see increased fees up to 1% of the loan value, or an adjustment in the rate.

If you are seeking a mortgage in excess of $417,000, recent legislation may enable lenders in certain locations to provide rates that are different from those shown in the table below. We recommend that you contact us by Email directly to determine what rates may be available to you.

| National Average Mortgage Rates | |||

|---|---|---|---|

| Description | APR This Week | APR Last Week | |

| Home Equity Line of Credit | 4.902% | 4.920% | |

| 15 Year Fixed Conforming | 4.424% | 4.341% | |

| 15 Year Fixed Jumbo | 5.173% | 5.083% | |

| 30 Year Fixed Conforming | 5.086% | 4.954% | |

| 30 Year Fixed Jumbo | 5.792% | 5.607% | |

| 5/1 Year ARM Conforming | 3.992% | 3.998% | |

| 5/1 Year ARM Jumbo | 4.644% | 4.571% |

Feel free to get the best mortgage quotes and mortgage advice by contacting us by Email with no obligations. We have great products for Palm Beach County FL and the entire state of Florida.

Palm Beach Mortgage is ready to help you.

Labels:

Florida,

Jumbo,

Jumbo-Loan,

Jumbo-Mortgage,

Lenders,

Loan,

Loans,

Mortgage,

Mortgages,

Palm-Beach-Mortgage

Thursday, March 18, 2010

Palm Beach Mortgage Rate Information

The rates on this page are typically valid for credit scores of 700 and above. For scores from 680 to 699, borrowers would typically see increased fees up to 1% of the loan value, or an adjustment in the rate.

If you are seeking a mortgage in excess of $417,000, recent legislation may enable lenders in certain locations to provide rates that are different from those shown in the table below. We recommend that you contact us by Email directly to determine what rates may be available to you.

| National Average Mortgage Rates | |||

|---|---|---|---|

| Description | APR This Week | APR Last Week | |

| Home Equity Line of Credit | 4.925% | 4.927% | |

| 15 Year Fixed Conforming | 4.345% | 4.381% | |

| 15 Year Fixed Jumbo | 5.092% | 5.101% | |

| 30 Year Fixed Conforming | 4.991% | 4.965% | |

| 30 Year Fixed Jumbo | 5.702% | 5.727% | |

| 5/1 Year ARM Conforming | 3.961% | 3.963% | |

| 5/1 Year ARM Jumbo | 4.577% | 4.576% |

Feel free to get the best mortgage quotes and mortgage advice by contacting us by Email with no obligations.

Palm Beach Mortgage is ready to help you.

Sunday, March 14, 2010

Palm Beach Mortgage Rates

National Average Mortgage Rates

The rates on this page are typically valid for credit scores of 700 and above. For scores from 680 to 699, borrowers would typically see increased fees up to 1% of the loan value, or an adjustment in the rate.

If you are seeking a mortgage in excess of $417,000, recent legislation may enable lenders in certain locations to provide rates that are different from those shown in the table below. We recommend that you contact us by Email directly to determine what rates may be available to you.

The rates on this page are typically valid for credit scores of 700 and above. For scores from 680 to 699, borrowers would typically see increased fees up to 1% of the loan value, or an adjustment in the rate.

If you are seeking a mortgage in excess of $417,000, recent legislation may enable lenders in certain locations to provide rates that are different from those shown in the table below. We recommend that you contact us by Email directly to determine what rates may be available to you.

Friday, March 5, 2010

Get a Jumbo Loan

The Jumbo Loan market is starting to pick up.

Therefore People wanting to move-up to a Luxury Estate will have Funding sources.

In the last few weeks, the average interest rate on a 30-year fixed-rate jumbo fell to 5.79 percent, a five-year low, according to rate tracker Informa Research Services. It is possible to get a lower Rate on hybrid adjustables.

It appears Banks are feeling more confident since Fannie Mae, Freddie Mac, and the Federal Housing Administration do not insure theses Jumbo Mortgages.

Thursday, March 4, 2010

Palm Beach Mortgage Information

Florida mortgage news, information, and advice.

Contact us through Email for Consultations.

Let us obtain you a Mortgage for Purchase or a Refinance.

We do Investment Property or Owner Occupied Loans.

Jumbo Mortgages or Commercial Financing available also.

Contact us through Email for Consultations.

Let us obtain you a Mortgage for Purchase or a Refinance.

We do Investment Property or Owner Occupied Loans.

Jumbo Mortgages or Commercial Financing available also.

Subscribe to:

Comments (Atom)