The rates on this page are typically valid for credit scores of 700 and above. For scores from 680 to 699, borrowers would typically see increased fees up to 1% of the loan value, or an adjustment in the rate.

If you are seeking a mortgage in excess of $417,000, recent legislation may enable lenders in certain locations to provide rates that are different from those shown in the table below. We recommend that you contact us by Email directly to determine what rates may be available to you.

| National Average Mortgage Rates | |||

|---|---|---|---|

| Description | APR This Week | APR Last Week | |

| Home Equity Line of Credit | 4.902% | 4.920% | |

| 15 Year Fixed Conforming | 4.424% | 4.341% | |

| 15 Year Fixed Jumbo | 5.173% | 5.083% | |

| 30 Year Fixed Conforming | 5.086% | 4.954% | |

| 30 Year Fixed Jumbo | 5.792% | 5.607% | |

| 5/1 Year ARM Conforming | 3.992% | 3.998% | |

| 5/1 Year ARM Jumbo | 4.644% | 4.571% |

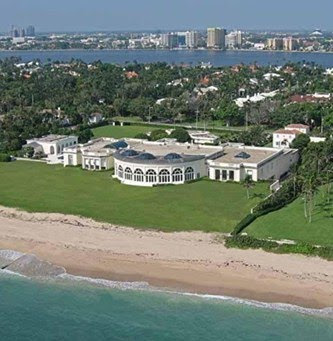

Feel free to get the best mortgage quotes and mortgage advice by contacting us by Email with no obligations. We have great products for Palm Beach County FL and the entire state of Florida.

Palm Beach Mortgage is ready to help you.